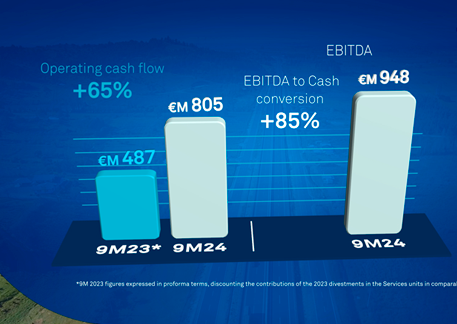

Sacyr has obtained an operating cash flow of €805 million from January to September 2024, 65% more than in the same period of 2023.

Cash flow is the indicator that best reflects growth and value generation in a company like Sacyr, in which 90% of EBITDA comes from P3 assets, in most cases with no demand risk or risk mitigation mechanisms. Through September, 85% of the EBITDA was converted into cash flow, compared to 50% in the same period of 2023.

Revenues reached €3,262 million (+1%) up to September. EBITDA stood at €948 million (-2%) and net profit reached €74 million (+1%).

Recourse net debt stood at €215 million by Q3 2024 end. Net investment in 2024 reaches €577 million.

New P3 contracts and project commissionings

Sacyr has won four P3 projects in 2024: Lima’s Peripheral Ring Road in Peru, Turin’s Health Complex in Italy, and the Northern Airport Network and Ruta del Itata in Chile. These contract awards are proof of the company's high success rate in tender processes.

In addition, last August the company reached financial close of the I-10 Calcasieu River Bridge project in Louisiana (USA). This P3, where Sacyr is partners with Acciona and Plenary, calls for a $3.4 Bn investment and boasts a concession term of 50 years.

As for commissioned projects, this year the Uruguay Central Railway has come into operation, with an investment of €915 million, and so has the last section of the Pamplona-Cucuta highway (Colombia), with a total investment of €592 million.

On the other hand, Sacyr Water was awarded the expansion and operation of the desalination plants of Torrevieja and Alicante (Alicante), Carboneras (Almeria), and Aguilas (Murcia).

Capital increase

Last May, Sacyr carried out a €222 million non-preemptive share capital increase. Net proceeds of this operation will fund the company’s investment needs through 2027.

This operation will provide more liquidity to the company’s shares and greater financial flexibility with which to reach an investment grade rating, one of the major goals for the 2024-2027 strategic cycle.

Voreantis and asset rotation

Also in May, at the presentation of its 2024-2027 Strategic Plan, Sacyr announced the creation of a new investment vehicle that will pool most part of the company’s assets in operation.

This new company, called Voreantis, will welcome a stable minority share partner with up to 49% stake, with the aim of generating resources to expand in P3 activities, highlight asset value and co-invest.

The company is currently working on the vendors due diligence and other relevant information, and in upcoming months, will go into the pre-marketing and definition of company perimeter stage.

Asset valuation

Sacyr has a P3 asset portfolio with an average life of 28 years. These assets amount to €3,551 million in valuation and €22 Bn in managed investment by 2024 year-end.

Since 2022, Sacyr has won 11 P3 projects and brought 11 into operation. These figures are reflective of the company’s growth platform strength.

Record shareholder remuneration

In 2024, Sacyr has paid a record shareholder remuneration of €0.141 per share. Payment was carried out through two scrip dividends. 92% of investors chose new shares.

Performance by business unit

Concesiones. - Sacyr Concesiones obtained a €614 million EBITDA (+3%), thanks to the contribution of the commissioned toll road projects, such as Rutas del Este (Paraguay), Ferrocarril Central (Uruguay) and Pamplona-Cúcuta (Colombia). El Loa Airport (Chile) and the good operational performance of other assets such as the Ruta 78 toll road (Chile) also contributed to improved results.

In addition to the financial close of the I-10 Calcasieu River Bridge project, Sacyr Concesiones carried out the financial close of the new Velindre Cancer Centre (United Kingdom), a state-of-the-art cancer care facility, which is expected to be operational in 2027.

Engineering and Infrastructure. - The strategy of this business unit prioritizes profitability over volume and risk control and reduction in third-party projects. As a result of this strategy, the project backlog proportion for Sacyr Concesiones now exceeds 67%.

EBITDA stood at €286 million up to September and turnover reached €1,974 million.

The backlog increased by 32% to €9,938 million, covering 53 months of activity. Noteworthy project awards in recent months include the I-10 Calcasieu River Bridge project in Louisiana (USA), Lima’s Peripheral Ring Road in Peru, the new Velindre Cancer Centre in Wales (United Kingdom) and Chile’s Northern Airport Network.

The EBITDA margin for the construction activity stood at 4.8%.

Water.– In its first year as an independent business unit, Sacyr Water has achieved a turnover of €180 million (+5%) and an EBITDA of €37 million (+5%) up to September.

This growth is due to the good operational performance of the projects, especially those in Chile and Australia.

Sacyr Water has been successful in several tender processes in Spain: the desalination plants in Torrevieja, Carboneras and Alicante and the Cuevas de Almanzora drinking water treatment plant (DWTP).