Growth in P3 activities

We aim to fast-track our growth. So, we have created a new company, Voreantis, that will pool brownfield assets and where we will welcome a minority stake partner.

We will triple our asset valuation in 2033.

Invested equity 4.5 -

5 €Bn

Asset valuation 9 -

10 €Bn

Our vision

We aim to fast-track our growth. So, we have created a new company, Voreantis, that will pool brownfield assets and where we will welcome a minority stake partner.

We strive to achieve investment grade rating, guided by our strict financial discipline.

Read more

Our shareholder remuneration policy will include the payment of at least €225 M in cash for the 2024-2027 period.

Read more

Ambitious goals

€850M Operating Cash Flow by 2023

€1,350M Operating Cash Flow by 2027

Operating cash flow is the indicator that best reflects value generation at Sacyr.

A new single company structure with three integrated business activities creating synergies for our value creation strategy.

Main priorities

Roads

Roads Hospitals

Hospitals Airports

Airports Universities

Universities Rail

RailFinancial goals P3 ASSET DISTRIBUTIONS

2023 220 M€

2024-2027 1,000 M€

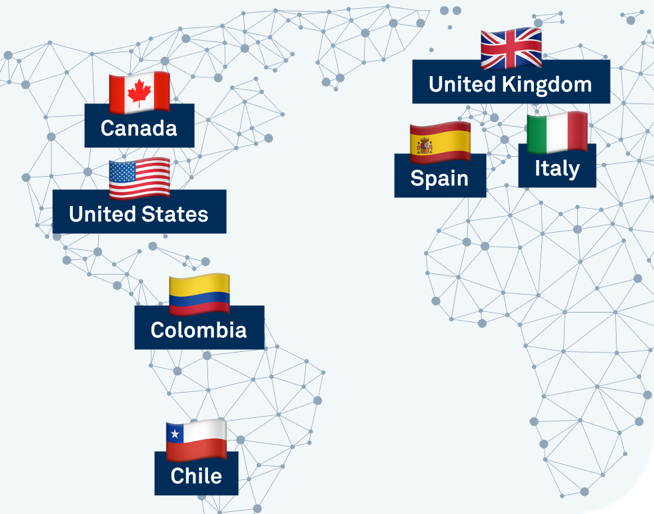

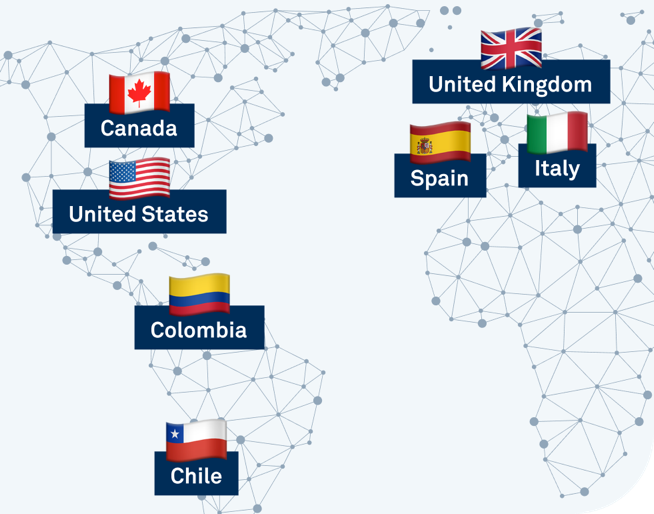

PORTFOLIO AND TARGET MARKETS

57 assets in 12 countries

Pipeline

Main priorities

Integrated Water Cycles

Integrated Water Cycles Plants

Plants O&M Contracts

O&M ContractsFinancial goals

Portfolio

+100 facilities built

Pipeline

Main priorities

Roads

Roads Airports

Airports Rail

Rail Hospitals

Hospitals Water

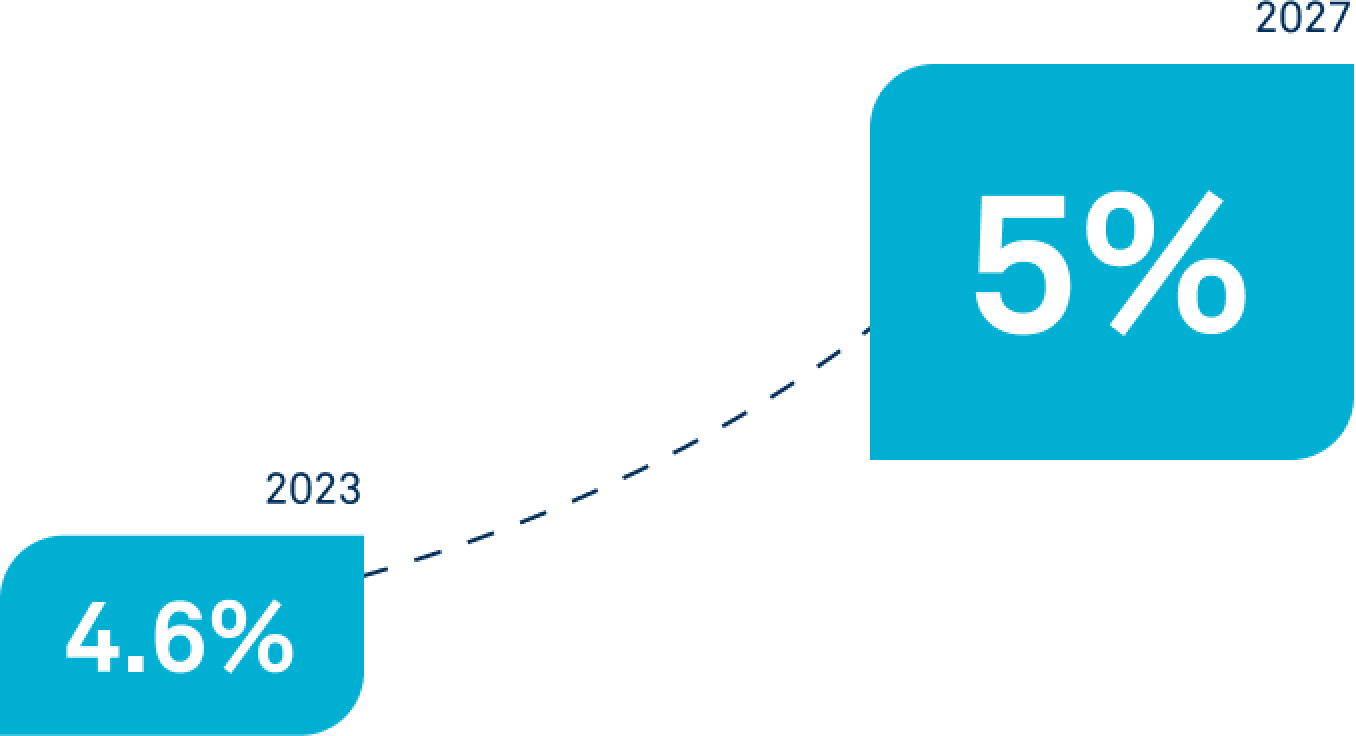

WaterFinancial goals PROFITABILITY

Portfolio in 2027

Priority countries

Our pillars

We will fast-track our growth in the P3 market focused on expanding activities in English-speaking markets.

We will create a company, called Voreantis, where we will incorporate a minority stake partner.

Company is expected to triple size by 2033 due to greater equity investment in new P3 projects.

Alliance with a partner

We remain committed to achieving will an investment grade rating, thanks to our strict financial discipline.

A steadfast commitment to financial discipline allows us to make progress in our debt reduction process towards a positive net cash position.

Our focus is on maintaining an investment-grade credit rating. We will keep the recourse net debt by EBITDA plus P3 distributions ratio under 1x.

2024-2027 goal

Recourse net debt

Positive net cash position

Over the 2024-2027 period, the company will pay out at least €225 million in cash to shareholders

In recent years, the company has kept continual dividend growth.

A new shareholders’ remuneration policy aligned with the expected operating cash flow increase.

Consistent dividend yield growth from 4.0% to 4.9%

2020-2023

Cash dividend

growing anually.

ESG

Our 2021-2025 set our roadmap on our sustainability ambition, which was fulfilled well ahead of schedule thanks to company-wide collective efforts. Our aim is to continue to be a benchmark in sustainability, maximizing the positive impact on our stakeholders.

This is our Sacyr 24-27 Sustainable Route

Planet

Continuity of the climate change strategy and validation of our 2050 net zero emissions target (SBTi).

Continue to improve positive impact on natural resources.

People

We are a benchmark in health and safety at work, and a leading employer for our commitment to diversity.

Prosperity

Maximize our impact on the communities within our influence areas and promoting safer and more sustainable practices.

Governance

Implementation of corporate governance commitments and international best practices.

Our strategic vision for the next ten years, will push Sacyr to develop its full potential to become the world’s leading greenfield project developer in 2033 by tripling the value of the current portfolio to the 9-10 €Bn range and invested equity to 4.5-5 €Bn