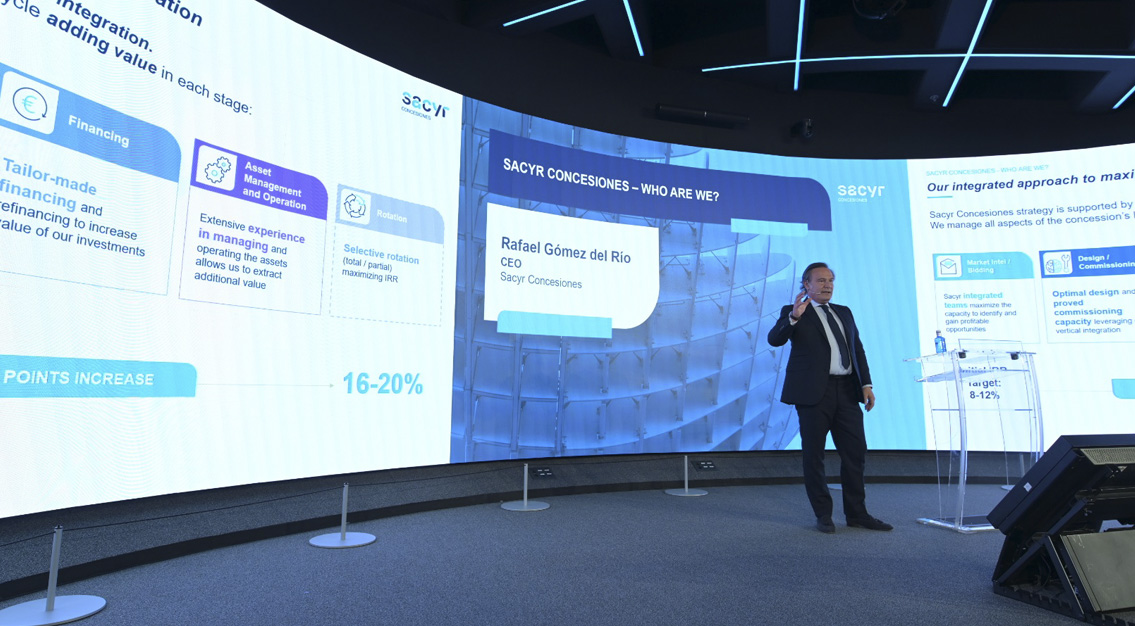

Sacyr has celebrated its Investor Day 2021, an event that gathers analysts and investors, in which we detailed Sacyr Concesiones’ strategy for the next fiscal years.

Active in 15 countries and with 65 assets in its portfolio, 15 of which are under construction, Sacyr’s subsidiary is an example in the P3 concessions sector. The investment managed by the concession company is 18,200 million euros, and the future revenue backlog reaches 36,000 million euros.

As of this year, Sacyr Concesiones generates enough cash flow to finance the investment commitments of its projects and distribute dividends to the holding company.

Valuation

According to Sacyr Concesiones’ spokespeople on Investor Day, the company estimates that today, the company’s value rises to 2.800 million euros. This figure was calculated using the CFC method and, in the case of Sacyr Water, the EBITDA multiple formula, both commonly used company valuation methods.

The value of the current assets in the portfolio will reach 3,700 million euros in 2025.

80% of the EBITDA

P3 concessions are the core of Sacyr’s activity, and they stand for 80% of the company’s EBITDA. Between 2015 and 2020, Sacyr Concesiones registered a steep growth, as it doubled its income and EBITDA in this period.

The 2021-2025 Strategic Plan forebears a new expansive cycle for Sacyr Concesiones, in which the EBITDA will almost triple from 365 million euros in 2020 to approximately 1,000 million euros. This will mean 85% of the group’s EBITDA. This growth only accounts for the contribution of the assets already in the portfolio.

This growth in Sacyr’s concessional activity will be compatible with the company’s drastic corporate debt reduction. The goal for 2025 is to situate recourse debt at around 100 million euros.

Successful track record

Today’s valuation reflects the success of Sacyr Concesiones’ business model, proven by the tenders won in the past two years that incorporated six new P3. It is noteworthy to mention the entry in two new markets, the United States and Brazil, and significant projects in other priority markets, like Italy and Chile.

Sacyr Concesiones has a 33% success rate in tender bids, which proves the company’s capacity to continue to create value in the future.

Commission capacity

Sacyr Concesiones has demonstrated its capacity to commission projects in the past few years. Between 2015 and 2020, the company has commissioned ten assets and expects to inaugurate 16 more before 2027.

Some of the most emblematic company assets will come into operation in 2022: Pedemontana, A3 and A5-A21 in Italy, AVO in Chile, and Rumichaca-Pasto and Autopista al Mar 1 in Colombia.

Competitive advantage

Sacyr’s P3-focused business model is successful for various reasons. Firstly, the group intervenes in all stages of the infrastructure value chain: from tender bidding, design, and financing, to construction, operation and maintenance, and rotation of aged, non-strategic assets.

Secondly, Sacyr Concesiones bases its growth on developing transport infrastructure with low demand risk. In fact, 96% of the company’s asset portfolio has low demand risk.

The concession firm’s financial soundness is another source of competitive advantage. Since 2021, Sacyr’s subsidiary can generate enough cash flow to finance new projects (480 million committed until 2021) and distribute dividends to the holding company: 1,000 million in the next five years.

Furthermore, the firm has high capacities and deep knowledge of the stock market, having executed financing and re-financing operations greater than 4,800 million euros in the past two years.

Among the executed operations, one that is particularly noteworthy is the first social bond issue in Latin America to refinance Montes de María roadway (Colombia) for 210 million dollars.

A sustainable and innovative proposal

Furthermore, Sacyr’s corporate strategy positions the company as a sector leader with a sustainable and innovative value proposal.

The group has reinforced its corporate government institutions and launched the 2021-2025 Sacyr Sustainable Action Plan. Through this plan, Sacyr pledges to fight against climate change, with the goal of being carbon neutral by 2050.

Sacyr will increase its investment in environmental protection by 50% and double innovation investment in the next five years. 70% of the funds destined for innovation will be dedicated to sustainable projects.