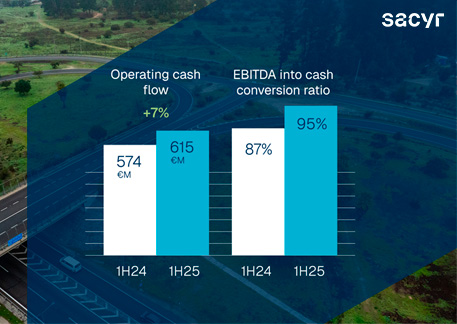

Sacyr generated €615 million in operating cash flow in the first half of 2025, a 7% increase compared to the same period in 2024. Cash flow is the key indicator that best reflects growth and value creation for a P3 developer like Sacyr, where 91% of EBITDA is derived from P3 assets. The majority of these assets either have no demand risk or benefit from risk mitigation mechanisms.

Revenue reached €2,237 million (+6%), with EBITDA at €647 million (-2%), net profit excluding divestments stood at €96 million (+85%).

Equity invested in P3 assets doubled in the first half of the year, reaching €208 million. Total equity invested now amounts to €1,993 million. Sacyr anticipates distributions exceeding €17 Bn, driven by a record six new contract awards in the last 12 months, as well as the increasing value of the group's asset portfolio over time.

Sacyr achieved a 95% EBITDA-to-cash conversion rate in the first half of the year, compared to 87% in the same period of 2024.

Sacyr met its target of maintaining a ratio of recourse net debt to EBITDA with recourse plus distributions below 1x. Recourse net debt stood at €297 million at the end of June. This figure will be significantly reduced with the funds from the sale of three assets in Colombia. This operation’s accounting impact placed net profit at €31 million, excluding variable amounts (earn-outs), valued at approximately $70 million, with a positive accounting and cash impact depending on the success of different claims currently in process.

Two new contract awards

In the first half of the year, Sacyr secured two new contracts: the Rutas del Este expansion in Paraguay and a water treatment and reuse and plant in Antofagasta, Chile.

In Paraguay, Sacyr Concesiones will enhance connectivity between the capital city, Asunción, and other cities in the interior. This project represents an investment of €163 million.

The Antofagasta water plant is the largest reuse project in Latin America, with a planned investment of $300 million from Sacyr Agua.

Furthermore, the contract for the Ruta del Itata P3 project in Chile was signed and operations began during this period. The investment is expected to be approximately €516 million. In early 2025, the company also commenced management of the Atacama Desert Airport (Chile), part of the Northern Airport Network.

Additionally, on July 1, Sacyr Concesiones began operating Ruta 68 (Chile), a project involving a €1,500 million investment and a maximum term of 30 years.

Growing asset valuation

Sacyr's portfolio of concession assets is projected to reach €3,957 million by year-end, an increase of €406 million compared to the most recent valuation (€3,551 million) conducted last December.

This increase in asset valuation demonstrates the robustness of the concession model and represents significant progress towards the Strategic Plan's objective of achieving a €5,100 million valuation by the end of 2027.

Cash dividend payment

In July, Sacyr distributed the first cash dividend (€4.5 gross cents per share) under the 24-27 Strategic Plan. According to this Plan, a minimum of €225 million in cash will be allocated to shareholder remuneration over the next three years.

In addition, in January, Sacyr paid a scrip dividend of one new share for every 40 old shares (€7.8 cents per right). 87% of shareholders elected to receive payment in Sacyr shares.

Performance by business area

Concessions.- Sacyr Concesiones recorded revenues of €818 million (-1%). While operating income decreased by 11%, construction revenues increased by 34% due to the progress of work on the Velindre Cancer Centre (United Kingdom) and the Buga-Buenaventura highway (Colombia). EBITDA amounted to €351 million (-18%), primarily due to the accounting impact of changes in financial assets.

Distributions from P3 projects totaled €101 million.

Engineering and Infrastructure.- This business line's strategy focuses on controlling and reducing risks in third-party projects. As a result, the proportion of the portfolio allocated to Sacyr Concesiones now stands at 70%, in line with the 2024-27 Strategic Plan.

The total backlog of the Engineering and Infrastructure division reached €10,811 million, a 2% increase compared to December 2024. The stable growth of the backlog covers 59 months of activity.

Key project awards during the semester include the Turin Health Complex in Italy (€332 million); the construction of the Alameda-Melipilla railway in Chile (€271 million); several real estate developments in Spain (€245 million); and the Northern Airport Network in Chile (€199 million), among others.

Revenue reached €1,446 million (+18%) and EBITDA reached €261 million (+34%). These increases are attributable to the contribution of the A-21 (Italy) and the progress of works in Spain, Chile and the United Kingdom.

The EBITDA margin for construction activity was 4.8%.

Water.- This business line experienced strong growth in the first half of the year, achieving a revenue of €139 million (+20%) and EBITDA of €32 million (+36%). Profitability, measured as EBITDA margin, increased by 280 basis points to 23.2%.

This double-digit growth is attributable to projects awarded in 2024, mainly in the Levante and Canary Islands regions, and the strong performance of international business in countries such as Australia.

The backlog grew by 54% and reached €7,408 million in the first half of the year. The award of the water reuse plant in Antofagasta (Chile) was a highlight of the period.