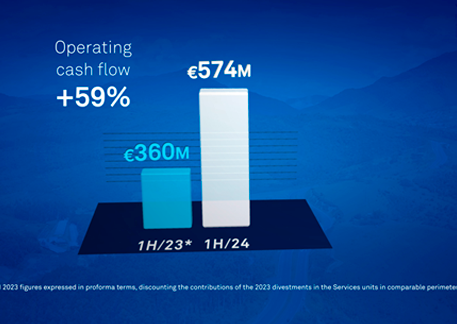

In 1H 2024, Sacyr obtained €574 million in operating cash flow, 59% higher than in the same period in 2023, and €657 million in EBITDA (+4.5%).

Operating cash flow is the indicator that best reflects growth and value generation at a company like Sacyr, with 90% of the EBITDA coming from low demand risk P3 assets. In 1H 2024, 87% of the EBITDA reverted to cash flow, as opposed to 57% in the same period of 2023.

On the other hand, net profit reached €52 million, 2.4% higher than in 1H 2023. Revenues stood at €2,119 million.

Recourse net debt decreased to €196 million as of June 30, 2024, €126 million less than in March 2024. Net investment in 1H 2024 was €77 million.

New P3 projects and commissioned projects

In 2024, Sacyr continues to reinforce its P3 activity, and its growth platform with the award of new assets and commissioned projects.

The company, as part of SIS consortium, signed the operation contract over five sections of the A21 and A5 highways in Turin. This P3 project, calling for a €1,127 million investment, will span 12 years.

In addition, a consortium that Sacyr is a member of was selected to develop a 34.8 km urban highway in Lima, Peru. The project calls for a €3,131 million investment, with a 30-year concession term.

A Sacyr Water consortium won the expansion and operation for four years of the Torrevieja desalination plant (Spain) for €90 million.

As for projects commissioned in 1H 2024, the Ferrocarril Central de Uruguay entered operation, with a €915 million investment, and well as the last section of Pamplona-Cucuta (Colombia) highway, with €592 million in total investment.

Capital increase

Last May, Sacyr launched a €222 million non-preemptive share capital increase. Proceeds of this capital increase will contribute to fund the company’s investment needs through 2027.

This operation is expected to aid the company in improving stock liquidity and attain greater financial flexibility to achieve an investment-grade rating, which is one of the goals for the 2024-2027 Strategic Plan.

Voreantis and asset rotation

In the presentation of its 2024-2027 Strategic Plan last May, Sacyr announced the creation of a new investment vehicle that will group most of the company’s P3 assets already in operation.

This new company, called Voreantis, will welcome a stable, minority stake partner with the aim of generating resources to drive P3 growth, highlight asset value and explore opportunities to co-invest.

Asset value

Sacyr has a 73 P3 asset portfolio, with an average lifecycle of 28 years. These assets are valued at €3,551 million and feature €22 Bn in managed investment.

Since 2022, Sacyr has won eight projects and has commissioned a total of 11. These figures demonstrate the strength of the company’s growth platform.

Shareholder remuneration

In January 2024, Sacyr paid a scrip dividend of €0.062/share or one new share for every 50 old shares. 92% of shareholders chose to be paid in shares. The next scrip dividend is planned for September.

Evolution by business unit

Sacyr Concesiones.- Sacyr Concesiones obtained €425 million in EBITDA (+6%) thanks to the contribution of projects that entered operation, such as Rutas del Este (Paraguay), Ferrocarril Central (Uruguay) and several sections of Pamplona-Cucuta (Colombia). El Loa Airport (Chile) and the performance of assets like Ruta 78, also in Chile, had a positive impact on results.

Sacyr Concesiones reached financial close of Velindre Cancer Centre (United Kingdom), a cutting-edge cancer treatment facility due to start operating in 2027.

Sacyr Engineering and Infrastructure.- Strategy for this business unit prioritizes profitability over volume. EBITDA was €195 million.

Backlog increased 21% to €9,143 million, equaling 53 months of activity. 80% of the new backlog comes from Sacyr Concesiones’ projects.

EBITDA margin of the construction unit was 4.9%.

Sacyr Water.- In its first semester as an independent business unit, Sacyr Water reached €116 million in revenues (+3%) and €24 million in EBITDA (+3%).

This growth is due to projects performing well, especially in Australia.

In this semester, Sacyr Water has won contract awards all over Spain: desalination plants in Torrevieja, Carboneras and Alicante and the Cuevas de Almanzora drinking water treatment plant (DWTP).