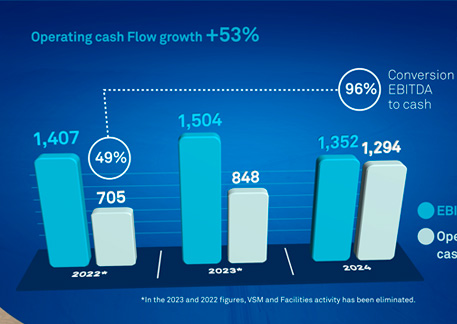

Sacyr obtained €1,294 million in operating cash flow of in 2024, 53% more than in 2023.

Cash flow is the indicator that best reflects growth and value creation in a company like Sacyr, in which more than 90% of EBITDA comes from P3 assets, mostly with no demand risk or with mitigation mechanisms related to demand risk.

In 2024, the company achieved an EBITDA-to-cash conversion rate of 96%, compared to 56% in 2023. This means that, in 2024, out of the €1,352 million in EBITDA, €1,294 million were converted to cash flow.

Revenues for the year reached €4,571 million (-0.8%), EBITDA stood at €1,352 million (-10%) and net profit was €113 million (+7.2%) compared to 2023, once eliminated the effect of the activities of VSM and Facilities and the divestment of the N6 (Ireland).

Sacyr met its goal of not exceeding the ratio of 1x recourse net debt by recourse EBITDA plus concessional distributions and kept it to 0.4. In 2024 recourse net debt dropped 46% to €146 million.

Record in contract awards

In 2024, Sacyr was awarded a record of five P3 project contracts, above and beyond the objectives set: Turin Health Complex (Italy), Lima’s Peripheral Ring Road (Peru) and Ruta 68, Ruta del Itata and the Northern Airport Network in Chile. These contract awards are proof of the company's high success rate in the tender processes in which it participates.

In August 2024, the company reached financial close of the I-10 Calcasieu River Bridge project in Luisiana (USA). Sacyr participates with Acciona and Plenary in this P3 project, which will require an investment of $3,370 million and will span for 50 years.

Commissioned projects in 2024 included the entry into operation of the Ferrocarril Central de Uruguay, with an investment of €915 million, the last section of the Pamplona-Cúcuta highway (Colombia), with a total investment of €592 million, and the A-21 highway in Italy, which will require investments worth €965 million.

On the other hand, Sacyr Water was awarded the expansion and operation of the desalination plants of Torrevieja and Alicante, both in Alicante, Carboneras (Almeria) and Águilas (Murcia).

Investments through 2027

In May 2024, Sacyr underwent a €222 million capital increase excluding pre-emptive subscription rights. The capital raised will contribute to covering the company's investment needs through 2027.

In addition, this operation will allow the company to improve share liquidity, as well as attain greater financial flexibility with which to achieve an investment grade rating, another goal for the 2024-2027 strategic cycle.

Voreantis and asset rotation

Last May, as part of the presentation of the 2024-2027 Strategic Plan, Sacyr announced the creation of an investment vehicle pooling most of the group’s brownfield assets.

This company, called Voreantis, will bring in a minority partner, with up to 49% of the capital. This partnership shall also be stable with the aim of generating resources to grow in the P3 business, highlight asset value and make the most of opportunities to co-invest.

Asset value

Sacyr has a portfolio of P3 assets with an average life of 28 years and valued in €3,551 million.

Since 2022, Sacyr has won 12 P3 projects and has put 12 into operation. These figures reflect the strength of the company's growth platform.

Record shareholder remuneration

In 2024, Sacyr paid out a record of €0.141 per share in shareholder remuneration, 72% more than in 2020. The payment was made through two scrip dividends, in which 92% of shareholders chose to receive shares.

In addition, in January 2025 the company paid another scrip dividend of one new share for every 40 old shares (0.078 euros per share).

As established in the 24-27 Strategic Plan, at least €225 million are earmarked to shareholder remuneration in cash over the next three years.

The Board of Directors will bring to the company’s Annual General Meeting the proposition to include Pedro Sigüenza, current CEO of Sacyr Concesiones, in the Board of directors, to be later appointed Sacyr CEO, with competences over business development and management decisions. The Chairman, Manuel Manrique, will hold on to corporate, financial, and strategic competences. With Sigüenza’s appointment, Sacyr continues to improve its commitment to corporate governance best practices.

Evolution by business area

Concesiones. - Sacyr Concesiones obtained €875 million (-2%) in EBITDA and operating income of €1,340 million (+5%), thanks to the contribution of the assets put into operation, such as Rutas del Este (Paraguay) and Ferrocarril Central de Uruguay and the good operational performance of Ruta 78 and El Loa Airport (Chile); as well as the contribution of financial assets such as the new Velindre Cancer Centre (United Kingdom) and Buga – Buenaventura in Colombia.

Construction revenues fell to €408 million (-38%) due to the completion of the works on Rutas del Este (Paraguay), Ferrocarril Central de Uruguay and Pamplona-Cúcuta (Colombia).

Sacyr Concesiones reached financial close of the I-10 Calcasieu River Bridge (Lousiana, United States) and the new Velindre Cancer Centre (Wales, United Kingdom), a state-of-the-art cancer facility expected to come into operation in 2027.

Engineering and Infrastructure. - The strategy of this business activity focuses on risk control and reduction in projects for third parties. As a result of this strategy, the weight of the work backlog for Sacyr Concesiones now stands at 71%, in line with the 2024-2027 Strategic Plan.

The overall Engineering and Infrastructure backlog stood at a record €10.6 billion by 2024 year-end, with an annual growth of 41%.

EBITDA stood at €422 million and revenues reached €2,741 million.

The EBITDA margin for the construction activity stood at 4.8%.

Water.– In its first year as an independent business activity, Sacyr Water achieved revenues of €245 million (+8%) and €51 million (+3%) in EBITDA.

This growth is due to the good operating performance of the projects, especially those in Chile and Australia, and the success in awarding different contracts in Spain: desalination plants in Torrevieja, Carboneras and Alicante and the drinking water treatment plant (DWTP) in Cuevas de Almanzora (Almería).